Bill Manager

Pinwheel's Bill Manager enables banks to provide their end users with frictionless detection, switching and management of recurring bills or payments. Integrated seamlessly into a bank's online and mobile portals, Bill Manager helps banks achieve primacy with the ability to capture their customers' recurring payments, and boosts customer retention by making the banking platform their customers' preferred hub for financial management.

Key features include:

- Instant detection of recurring bills across connected accounts on the user's behalf

- Visibility into recurring payments and their upcoming payment due dates to avoid overdraft and late fees

- Seamless switching for both card and ACH payments

- Tracking of which recurring have been switched and which switches are outstanding

- Ongoing management including regular scans for new recurring payments hitting both the new and legacy accounts

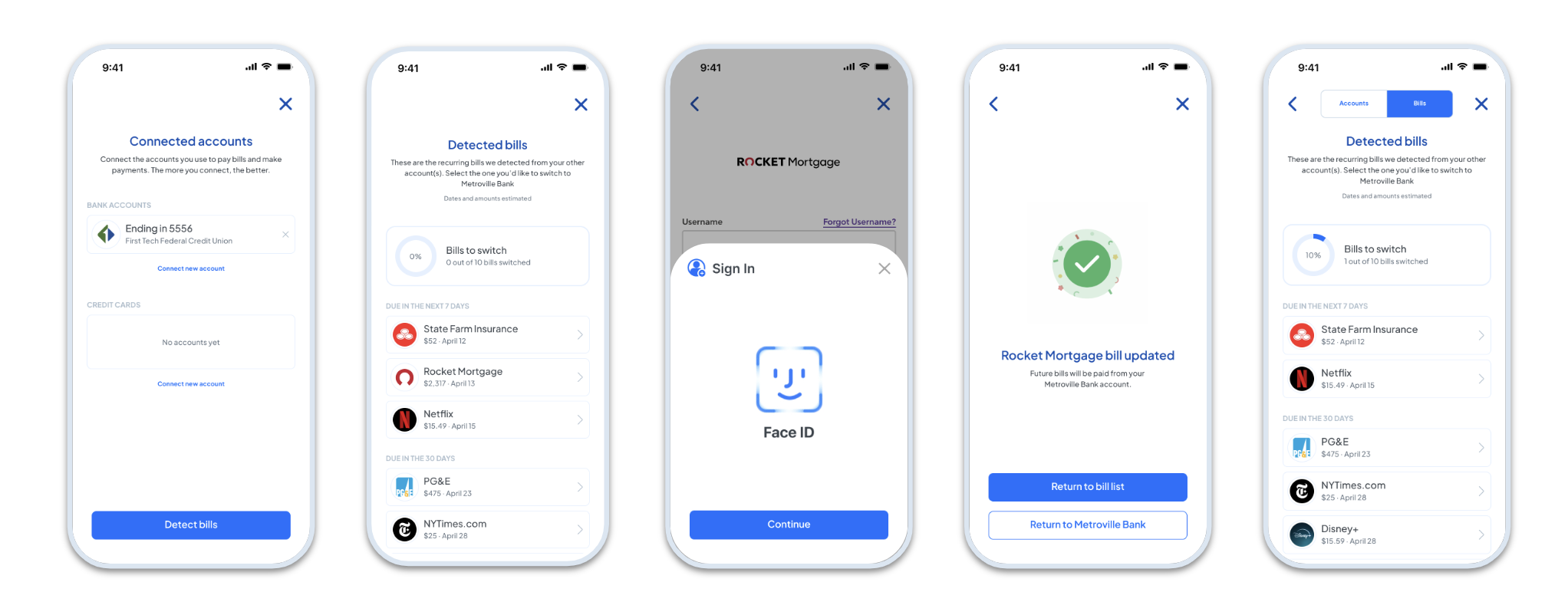

How Bill Manager works:

- The end user is prompted to connect their external bank and credit card accounts

- Leveraging Pinwheel’s data connectivity infrastructure, Bill Manager automatically detects recurring payments on the user's behalf, and surfaces a comprehensive view of the user’s recurring transactions across the linked external financial accounts

- Pinwheel's direct integrations to merchants enables the user to select a bill and update the payment method on file in real time

- The outcome of that switch is instantly communicated back to the user, and the status of that switch is tracked in the previously surfaced list of recurring payments

- Bill Manager regularly scans for new recurring payments across accounts to enable ongoing management of recurring payments

Note: In the cases where Automated Bill Switching is not available, Pinwheel provides users with instructions on how to complete the switch, as well as account/card information copy and paste capabilities to make the process as frictionless as possible.

Updated about 1 month ago